Over the previous few weeks, metals have been swinging wildly. I’ve been following Copper and Gold, and it has been a wild experience, to say the least. I will cowl off Copper and associated miners right this moment. As we look forward to the world of electrical automobiles to devour each ounce of copper, the main focus for copper mining and manufacturing stays excessive as inventories stay low.

One of many metallic mining ETFs is CPER, which trades like copper. It broke out to a better excessive in mid-July, persevering with a collection of upper lows and highs, solely to hole again down on Monday, July seventeenth. After a sideways week, copper surged on July twenty fifth and examined the prior highs. In a uneven week, copper darted round however closed close to the highs. On Monday, July 31, Copper surged increased with a transparent break above resistance. By Wednesday, all sense of a brand new excessive was gone and copper was again under the 100-MA.

There’s a development of rising highs and rising lows. The amount has been enhancing, however the quantity this week was properly outdoors the June interval. With the PPO rolling over onto a promote sign to finish the week, it is an awfully exhausting commerce to carry.

The exhausting half is copper is making increased highs and better lows, however every single day is a sudden transfer that is both supportive or damaging, making it exhausting to carry. Whereas many buyers may not personal copper instantly, some copper miners have been a sturdy commerce, making increased highs.

The chart under is COPX, which is the copper miners ETF. Clearly, a case will be made for increased highs and better lows. The troublesome half is the opening gaps up and down every single day. The excessive quantity bars appear to be indicative of short-term tops. Now that the COPX ETF is again on a promote sign on the PPO, is it value holding the metals all through the third quarter?

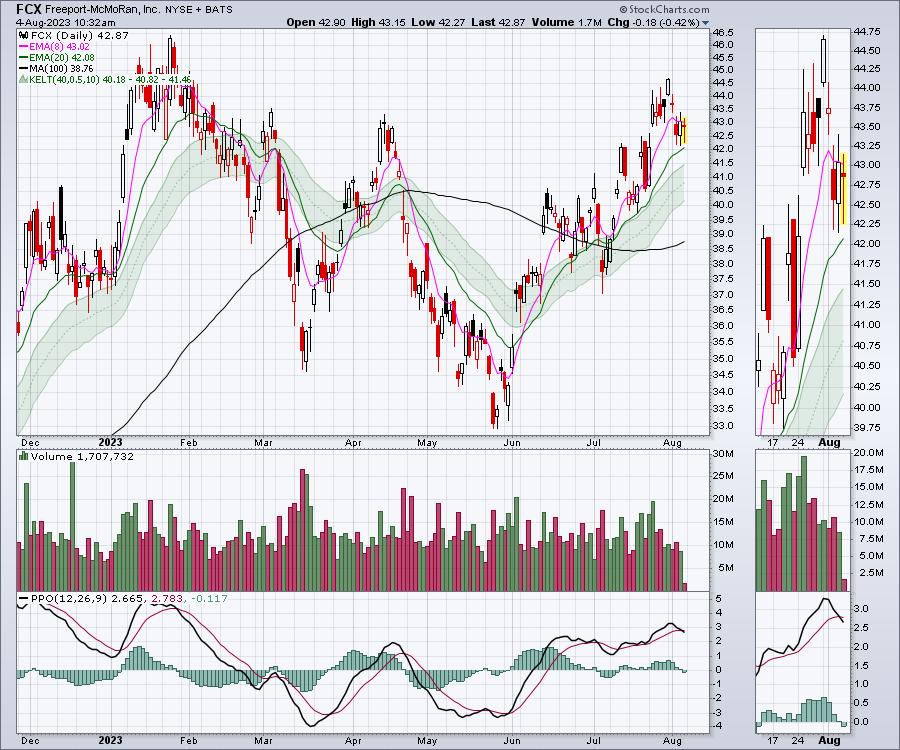

After I take a look at names like Freeport-McMoran (FCX) and Southern Copper (SCCO), their charts look good. The FCX chart has been pushing increased since June 1 by means of to July 31, however the PPO is rolling over onto a promote sign once more. Which means will worth go now?

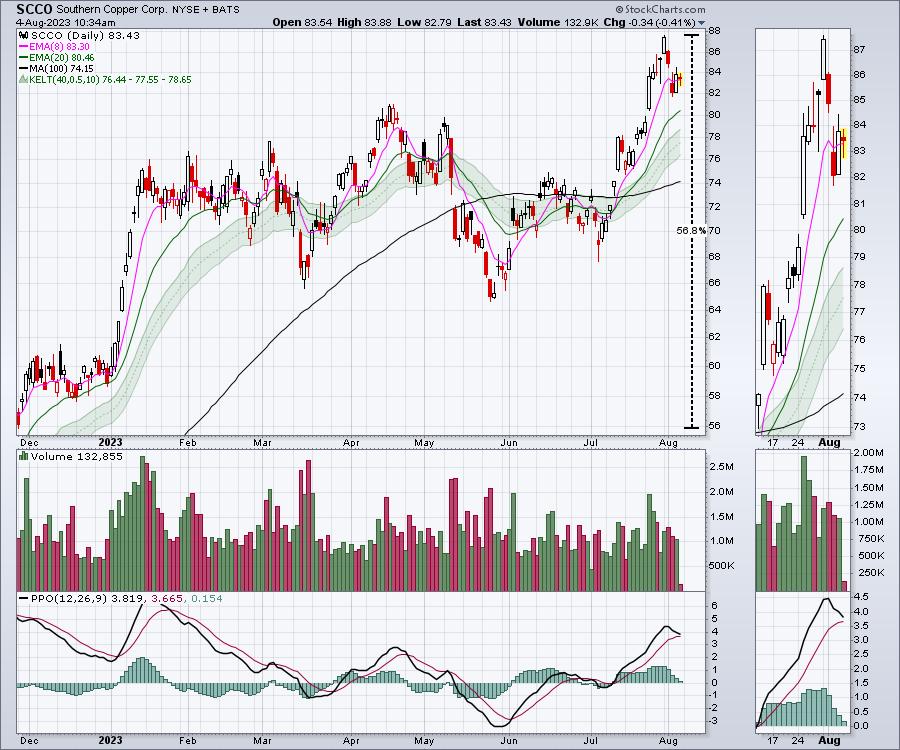

Taking a look at SCCO, this chart is even nicer. The inventory is up 56% from late November 2022 and broke out to new 52-week highs final week! Nonetheless, the PPO appears like it’s prepared for a promote sign.

The underside line is that the copper shares have been exhausting to carry and, with the indexes beginning to retrace, the most effective positive factors in copper names is perhaps behind us for a number of months. It’s so irritating, because the shares are simply beginning to make increased highs, however then rolled over in earnest to begin August.

The underside line is that the copper shares have been exhausting to carry and, with the indexes beginning to retrace, the most effective positive factors in copper names is perhaps behind us for a number of months. It’s so irritating, because the shares are simply beginning to make increased highs, however then rolled over in earnest to begin August.

Greg Schnell, CMT, MFTA is Chief Technical Analyst at Osprey Strategic specializing in intermarket and commodities evaluation. He’s additionally the co-author of Inventory Charts For Dummies (Wiley, 2018). Primarily based in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He’s an energetic member of each the CMT Affiliation and the Worldwide Federation of Technical Analysts (IFTA).