Value motion is probably the most direct info that merchants can use to establish market instructions. This additionally features a market reversal state of affairs, which is a excessive yielding commerce state of affairs. Nonetheless, most new merchants might discover it troublesome to establish development reversals primarily based on a unadorned chart. Development following indicators similar to those mentioned under could also be used to assist merchants establish and make sure development reversals inside the context of value motion with the intention to capitalize on commerce alternatives introduced by the market.

Easy Harmonic Index Indicator

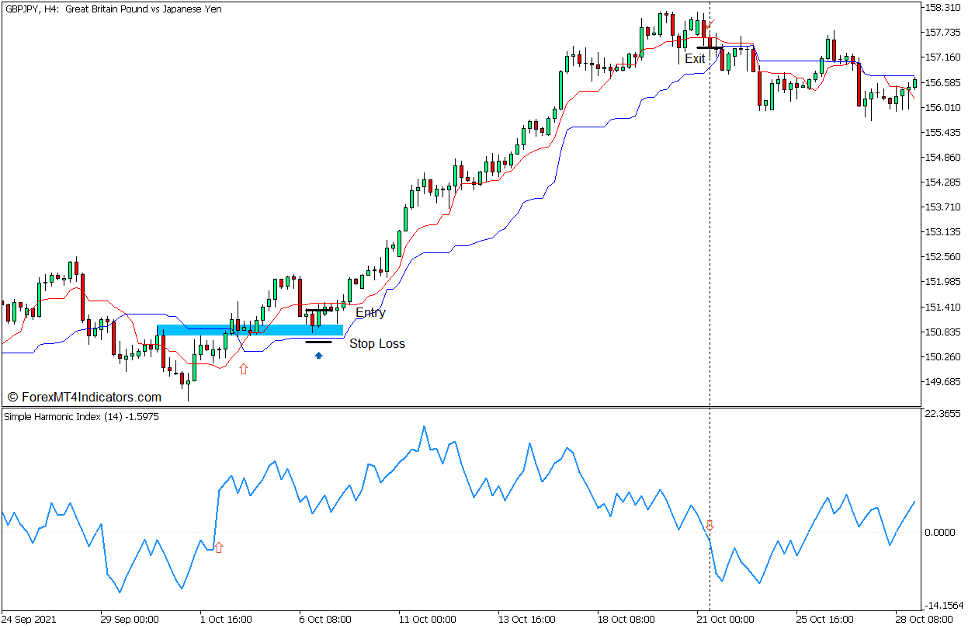

The Easy Harmonic Index (SHI) is a momentum-based technical indicator which detects the attainable route and bias of value primarily based on latest historic value actions. The SHI has an underlying algorithm which derives the route of momentum primarily based on latest value information. Its algorithm can use both the open, excessive, low, and shut of value, in addition to the Median Value, which is the common of the excessive and low of the bar, Typical Value, which is the common of the excessive, low, and shut, and the Weighted Value, which is the common of the open, excessive, low, and shut of value.

The ensuing worth coming from the indicator’s calculations is then used to plot an oscillator line. This line oscillates round its midline, which is zero.

The route of the market’s momentum is recognized primarily based on the oscillator line. Constructive values point out a bullish momentum, whereas damaging values point out a bearish momentum. As such, crossovers between the oscillator line and its marker at zero might point out a attainable development reversal. Trending markets are confirmed at any time when the SHI line is mostly staying above zero in an uptrend and under zero in a downtrend.

Tenkan-sen and Kijun-sen Traces

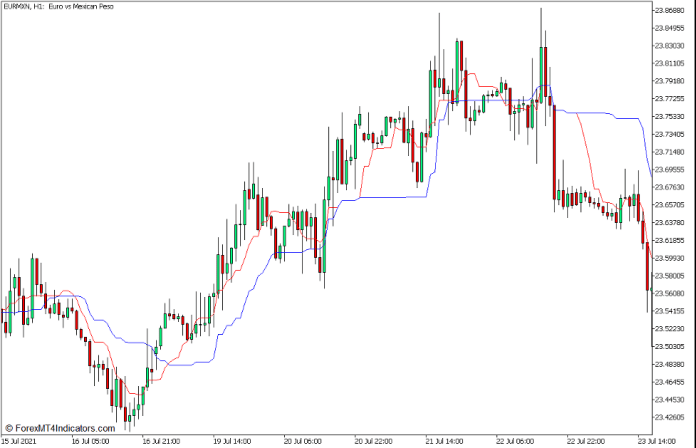

The Ichimoku Kinko Hyo indicator is a development following technical indicator which offers a whole overview of the market’s route. It offers short-term and long-term development indications utilizing 5 distinctive traces, every representing a development horizon primarily based on common value actions.

The Tenkan-sen and Kijun-sen traces are two of the quickest and most responsive common traces among the many 5 parts of the Ichimoku Kinko Hyo indicator. As such, these two traces are used to establish and detect the short-term development route.

The Tenkan-sen, which suggests Conversion Line, is the median of value over a 9 bar window. The indicator’s algorithm would establish the very best excessive and the bottom low inside the nine-bar window. It might then calculate for the median of value by including the very best excessive and the bottom low, then dividing the sum by two.

The Kijun-sen, also referred to as the Base Line, then again is the median of value over a 26-bar interval. Much like the Tenkan-sen, the indicator’s algorithm additionally detects the very best excessive and lowest low of value inside the final 26-bar window. It then provides the very best excessive and lowest low of value, then divides the sum by two.

Between the 2, the Tenkan-sen (crimson line) is the sooner transferring line relative to the Kijun-sen (blue line). The short-term development route is recognized primarily based on how the 2 traces work together with one another. Bullish development instructions are indicated by a Tenkan-sen line which is constantly above the Kijun-sen line. Inversely, bearish developments are indicated by a Tenkan-sen line which is mostly under the Kijun-sen line. Given this relationship, development reversals may be recognized primarily based on the crossing over of the 2 traces.

The realm between the Tenkan-sen and Kijun-sen traces may act as a dynamic space of assist or resistance in a trending market situation. Value might bounce from the realm between the 2 traces. As such, some merchants additionally use the Kijun-sen line as a foundation for putting and trailing cease losses.

Buying and selling Technique Idea

Easy Harmonic Index Reversal Foreign exchange Buying and selling Technique is a development reversal buying and selling technique which makes use of the Tenkan-sen and Kijun-sen traces to establish potential development reversals and the SHI line to substantiate the development route.

The preliminary development reversal is recognized primarily based on the crossing over of the Tenkan-sen and Kijun-sen traces. The brand new development is then confirmed by the SHI line crossing over the zero midline in confluence with the route of the Tenkan-sen and Kijun-sen reversal sign.

Except for the 2 indicators, value motion and market stream construction are additionally employed to establish potential development reversals. That is primarily based on value breaking by means of assist and resistance traces and pulling again to those ranges and rejecting it as soon as once more. The value rejection of the realm is then confirmed by an engulfing or momentum candle formation.

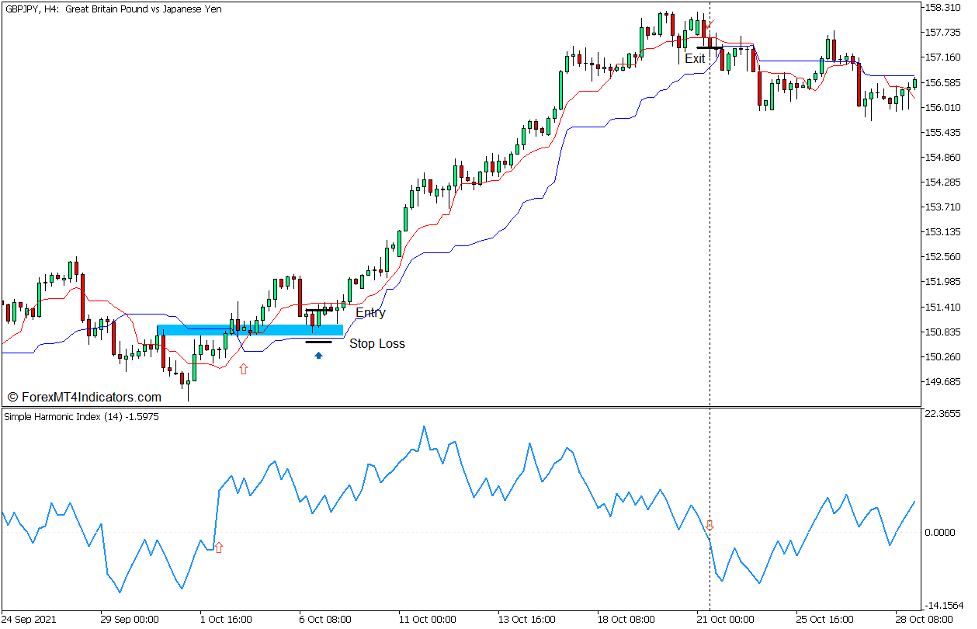

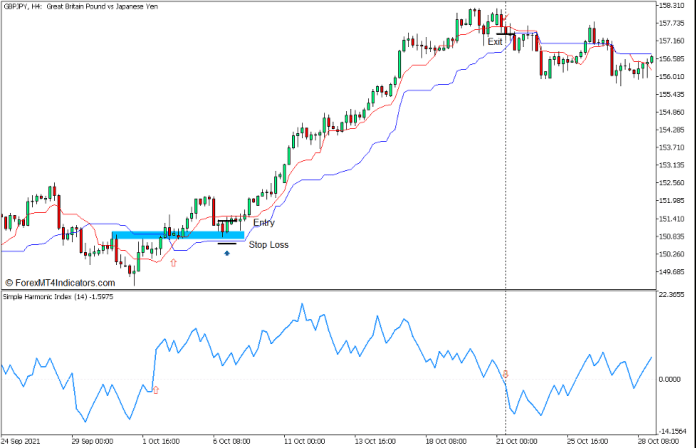

Purchase Commerce Setup

Entry

- The Tenkan-sen line ought to cross above the Kijun-sen line.

- Value ought to break above a latest swing excessive resistance.

- The SHI line ought to cross above zero.

- Value motion ought to pull again in direction of the resistance space turned assist which must also be in confluence with the realm between the Tenkan-sen and Kijun-sen traces.

- Open a purchase order as quickly as a bullish engulfing sample is fashioned.

Cease Loss

- Place the cease loss under the Kijun-sen line.

Exit

- Shut the commerce as quickly because the SHI line crosses under zero.

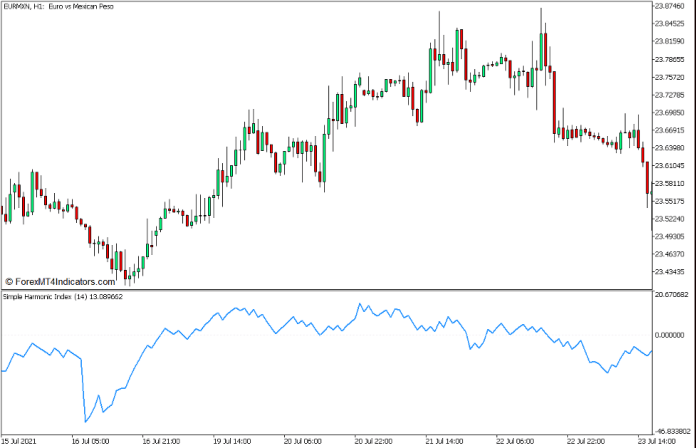

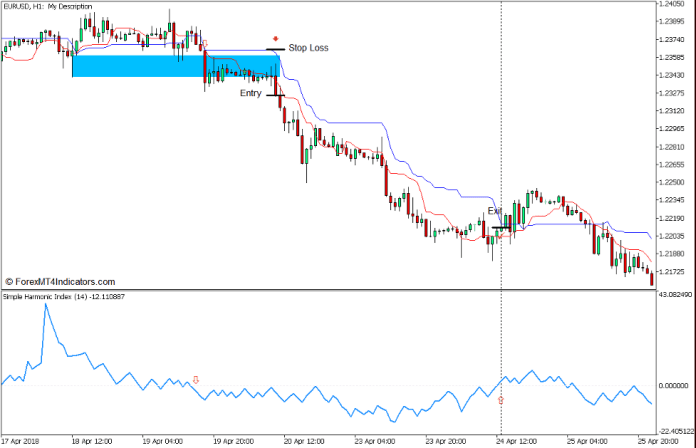

Promote Commerce Setup

Entry

- The Tenkan-sen line ought to cross under the Kijun-sen line.

- Value ought to drop under a latest swing low assist.

- The SHI line ought to cross under zero.

- Value motion ought to pull again in direction of the assist space turned resistance which must also be in confluence with the realm between the Tenkan-sen and Kijun-sen traces.

- Open a promote order as quickly as a bearish engulfing sample is fashioned.

Cease Loss

- Place the cease loss above the Kijun-sen line.

Exit

- Shut the commerce as quickly because the SHI line crosses above zero.

Conclusion

This technique is a simplified development reversal buying and selling technique which can be utilized even by newer merchants. It’s hinged across the idea of value motion breaking an opposing assist or resistance line transferring in opposition to the development, then pulling again in direction of the realm. The symptoms used merely provides readability to how the market is behaving. The visible indications of the Tenkan-sen, Kijun-sen, and SHI traces enable merchants to simply spot potential development reversals. Nonetheless, these indicators must be used inside the context of a market reversal value motion.

Foreign exchange Buying and selling Methods Set up Directions

Easy Harmonic Index Reversal Foreign exchange Buying and selling Technique for MT5 is a mixture of Metatrader 5 (MT5) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the gathered historical past information and buying and selling indicators.

Easy Harmonic Index Reversal Foreign exchange Buying and selling Technique for MT5 offers a possibility to detect varied peculiarities and patterns in value dynamics that are invisible to the bare eye.

Based mostly on this info, merchants can assume additional value motion and regulate this technique accordingly.

Really helpful Foreign exchange MetaTrader 5 Buying and selling Platforms

#1 – XM Market

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

#2 – Pocket Choice

- Free +50% Bonus To Begin Buying and selling Immediately

- 9.6 Total Score!

- Mechanically Credited To Your Account

- No Hidden Phrases

- Settle for USA Residents

set up Easy Harmonic Index Reversal Foreign exchange Buying and selling Technique for MT5?

- Obtain Easy Harmonic Index Reversal Foreign exchange Buying and selling Technique for MT5.zip

- *Copy mq5 and ex5 recordsdata to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Easy Harmonic Index Reversal Foreign exchange Buying and selling Technique for MT5

- You will notice Easy Harmonic Index Reversal Foreign exchange Buying and selling Technique for MT5 is obtainable in your Chart

*Be aware: Not all foreign exchange methods include mq5/ex5 recordsdata. Some templates are already built-in with the MT5 Indicators from the MetaTrader Platform.

Click on right here under to obtain: