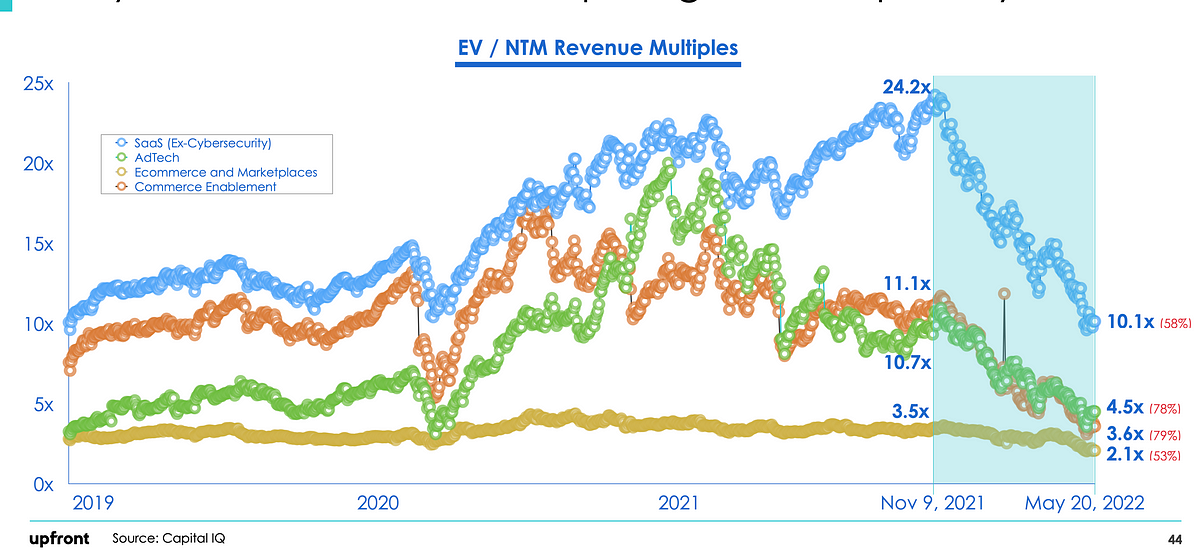

At our mid-year offsite our partnership at Upfront Ventures was discussing what the way forward for enterprise capital and the startup ecosystem seemed like. From 2019 to Might 2022, the market was down significantly with public valuations down 53–79% throughout the 4 sectors we have been reviewing (it’s since down even additional).

==> Apart, we even have a NEW LA-based companion I’m thrilled to announce: Nick Kim. Please observe him & welcome him to Upfront!! <==

Our conclusion was that this isn’t a short lived blip that may swiftly trend-back up in a V-shaped restoration of valuations however somewhat represented a brand new regular on how the market will worth these firms considerably completely. We drew this conclusion after a gathering we had with Morgan Stanley the place they confirmed us historic 15 & 20 yr valuation tendencies and all of us mentioned what we thought this meant.

Ought to SaaS firms commerce at a 24x Enterprise Worth (EV) to Subsequent Twelve Month (NTM) Income a number of as they did in November 2021? In all probability not and we predict 10x (Might 2022) appears extra in keeping with the historic development (truly 10x continues to be excessive).

It doesn’t actually take a genius to appreciate that what occurs within the public markets is very prone to filter again to the non-public markets as a result of the last word exit of those firms is both an IPO or an acquisition (typically by a public firm whose valuation is mounted day by day by the market).

This occurs slowly as a result of whereas public markets commerce day by day and costs then regulate immediately, non-public markets don’t get reset till follow-on financing rounds occur which may take 6–24 months. Even then non-public market traders can paper over valuation modifications by investing on the similar worth however with extra construction so it’s arduous to know the “headline valuation.”

However we’re assured that valuations will get reset. First in late-stage tech firms after which it can filter again to Development after which A and finally Seed Rounds.

And reset they need to. Once you have a look at how a lot median valuations have been pushed up prior to now 5 years alone it’s bananas. Median valuations for early-stage firms tripled from round $20m pre-money valuations to $60m with loads of offers being costs above $100m. In case you’re exiting into 24x EV/NTM valuation multiples you may overpay for an early-stage spherical, maybe on the “larger idiot idea” however if you happen to imagine that exit multiples have reached a brand new regular, it’s clear to me: YOU. SIMPLY. CAN’T. OVERPAY.

It’s simply math.

No weblog submit about how Tiger is crushing everyone as a result of it’s deploying all its capital in 1-year whereas “suckers” are investing over 3-years can change this actuality. It’s simple to make IRRs work rather well in a 12-year bull market however VCs must earn a living in good markets and unhealthy.

Up to now 5 years a number of the greatest traders within the nation may merely anoint winners by giving them massive quantities of capital at excessive costs after which the media hype machine would create consciousness, expertise would race to affix the subsequent perceived $10bn winner and if the music by no means stops then everyone is blissful.

Besides the music stopped.

There’s a LOT of cash nonetheless sitting on the sidelines ready to be deployed. And it WILL be deployed, that’s what traders do.

Pitchbook estimates that there’s about $290 billion of VC “overhang” (cash ready to be deployed into tech startups) within the US alone and that’s up greater than 4x in simply the previous decade. However I imagine will probably be patiently deployed, ready for a cohort of founders who aren’t artificially clinging to 2021 valuation metrics.

I talked to a few pals of mine who’re late-stage progress traders and so they mainly instructed me, “we’re simply not taking any conferences with firms who raised their final progress spherical in 2021 as a result of we all know there may be nonetheless a mismatch of expectations. We’ll simply wait till firms that final raised in 2019 or 2020 come to market.”

I do already see a return of normalcy on the period of time traders must conduct due diligence and ensure there may be not solely a compelling enterprise case but additionally good chemistry between the founders and traders.

I can’t converse for each VC, clearly. However the best way we see it’s that in enterprise proper now you have got 2 decisions — tremendous dimension or tremendous focus.

At Upfront we imagine clearly in “tremendous focus.” We don’t need to compete for the biggest AUM (belongings underneath administration) with the most important companies in a race to construct the “Goldman Sachs of VC” nevertheless it’s clear that this technique has had success for some. Throughout greater than 10 years we have now saved the median first examine dimension of our Seed investments between $2–3.5 million, our Seed Funds principally between $200–300 million and have delivered median ownerships of ~20% from the primary examine we write right into a startup.

I’ve instructed this to folks for years and a few folks can’t perceive how we’ve been capable of maintain this technique going by means of this bull market cycle and I inform folks — self-discipline & focus. In fact our execution towards the technique has needed to change however the technique has remained fixed.

In 2009 we may take a very long time to evaluation a deal. We may discuss with prospects, meet your complete administration group, evaluation monetary plans, evaluation buyer buying cohorts, consider the competitors, and many others.

By 2021 we needed to write a $3.5m first examine on common to get 20% possession and we had a lot much less time to do an analysis. We regularly knew concerning the groups earlier than they really arrange the corporate or left their employer. It pressured excessive self-discipline to “keep in our swimming lanes” of data and never simply write checks into the most recent development. So we largely sat out fundings of NFTs or different areas the place we didn’t really feel like we have been the professional or the place the valuation metrics weren’t in keeping with our funding objectives.

We imagine that traders in any market want “edge” … understanding one thing (thesis) or any individual (entry) higher than nearly every other investor. So we stayed near our funding themes of: healthcare, fintech, laptop imaginative and prescient, advertising applied sciences, online game infrastructure, sustainability and utilized biology and we have now companions that lead every follow space.

We additionally focus closely on geographies. I feel most individuals know we’re HQ’d in LA (Santa Monica to be actual) however we make investments nationally and internationally. We’ve got a group of seven in San Francisco (a counter wager on our perception that the Bay Space is a tremendous place.) Roughly 40% of our offers are finished in Los Angeles however almost all of our offers leverage the LA networks we have now constructed for 25 years. We do offers in NYC, Paris, Seattle, Austin, San Francisco, London — however we provide the ++ of additionally having entry in LA.

To that finish I’m actually excited to share that Nick Kim has joined Upfront as a Companion primarily based out of our LA places of work. Whereas Nick could have a nationwide remit (he lived in NYC for ~10 years) he’s initially going to deal with rising our hometown protection. Nick is an alum of UC Berkeley and Wharton, labored at Warby Parker after which most not too long ago on the venerable LA-based Seed Fund, Crosscut.

Anyone who has studied the VC business is aware of that it really works by “energy legislation” returns during which a number of key offers return nearly all of a fund. For Upfront Ventures, throughout > 25 years of investing in any given fund 5–8 investments will return greater than 80% of all distributions and it’s typically out of 30–40 investments. So it’s about 20%.

However I believed a greater mind-set about how we handle our portfolios is to consider it as a funnel. If we do 36–40 offers in a Seed Fund, someplace between 25–40% would doubtless see massive up-rounds throughout the first 12–24 months. This interprets to about 12–15 investments.

Of those firms that change into nicely financed we solely want 15–25% of THOSE to pan out to return 2–3x the fund. However that is all pushed on the belief that we didn’t write a $20 million try of the gate, that we didn’t pay a $100 million pre-money valuation and that we took a significant possession stake by making a really early wager on founders after which partnering with them typically for a decade or extra.

However right here’s the magic few folks ever discuss …

We’ve created greater than $1.5 billion in worth to Upfront from simply 6 offers that WERE NOT instantly up and to the suitable.

The fantastic thing about these companies that weren’t speedy momentum is that they didn’t elevate as a lot capital (so neither we nor the founders needed to take the additional dilution), they took the time to develop true IP that’s arduous to duplicate, they typically solely attracted 1 or 2 robust opponents and we might ship extra worth from this cohort than even our up-and-to-the-right firms. And since we’re nonetheless an proprietor in 5 out of those 6 companies we predict the upside might be a lot larger if we’re affected person.

And we’re affected person.